Inflation, Inflation, and the State of Gaming

I need to play my economist card here for a second and endorse the meme. Seriously, is no one ever going to adjust for inflation?

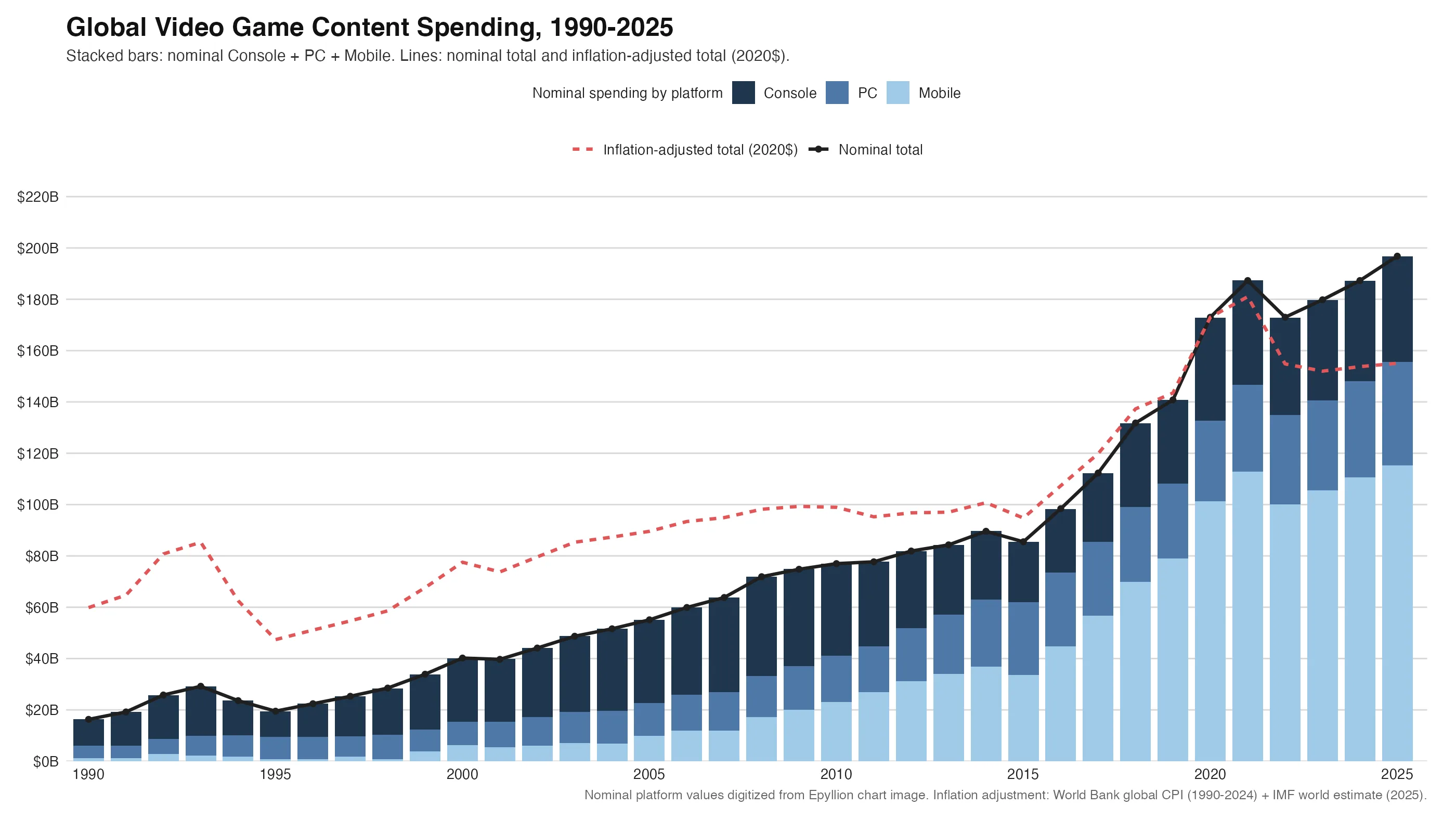

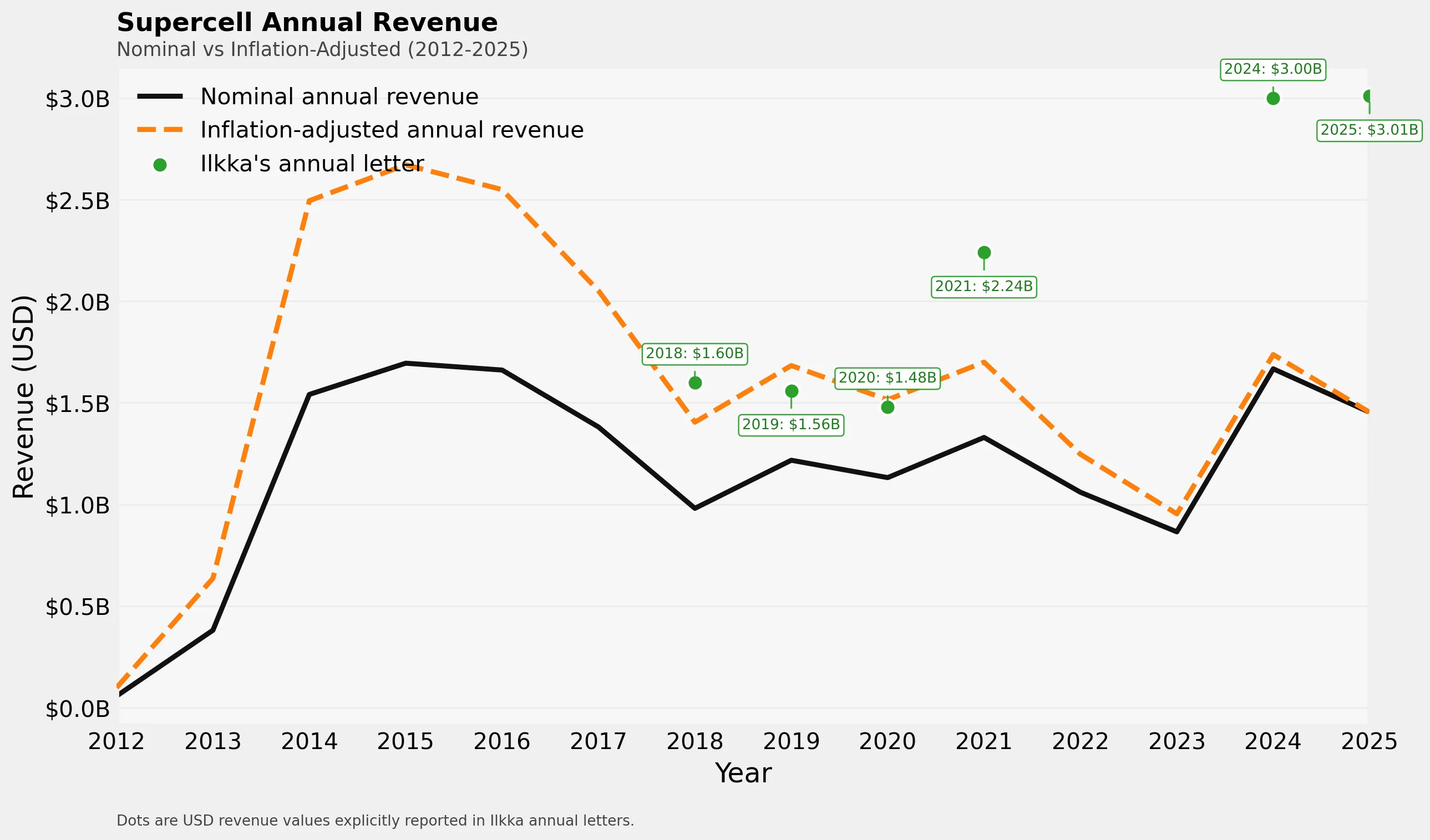

Both Supercell's claim in Ilkka Paananen's letter (Supercell did not match their highest years!) and Matthew Ball's The State of Video Gaming in 2026 report completely change when we adjust for conservative global inflation estimates from the IMF. Don't get me started on Newzoo.

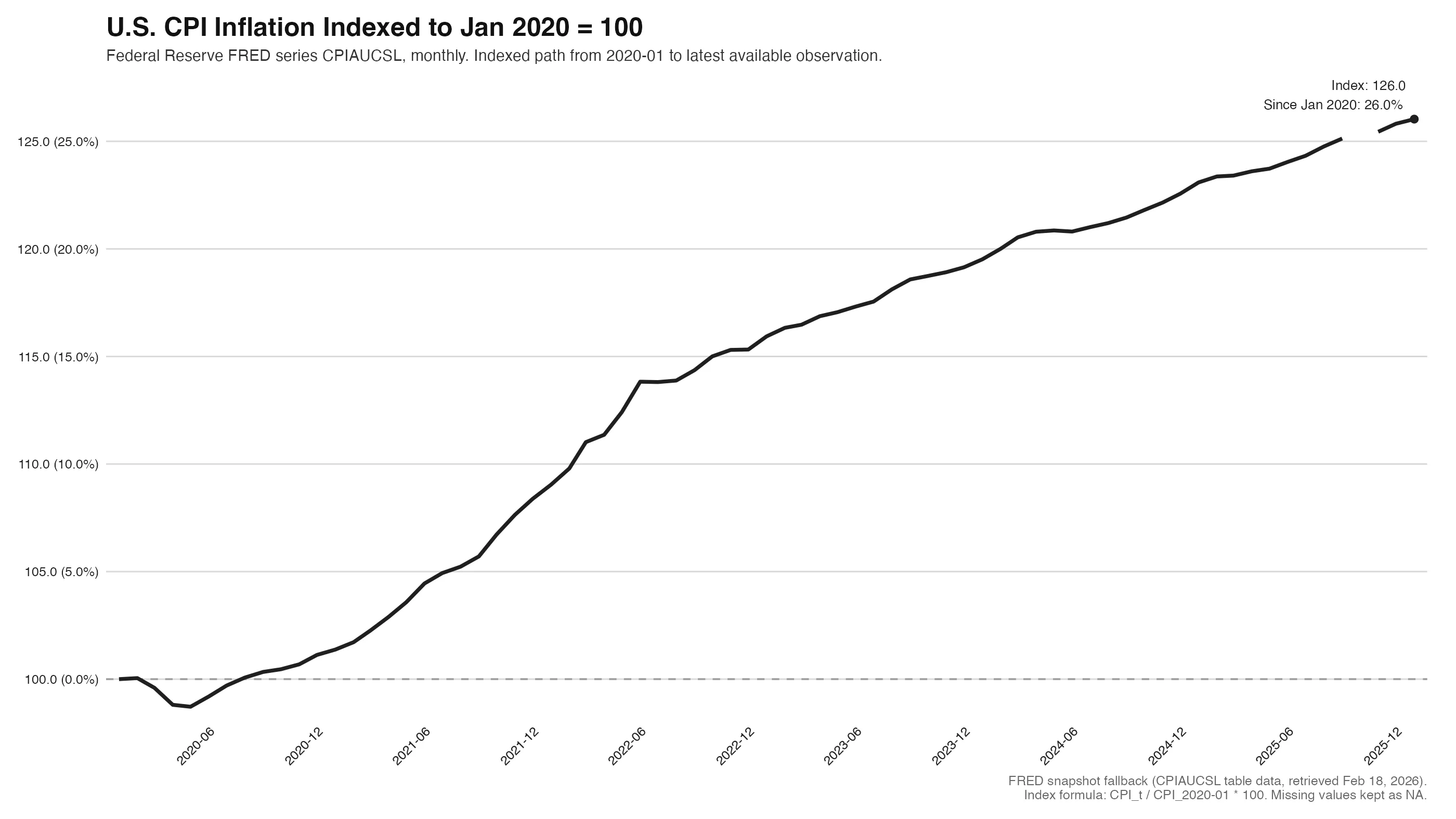

In the United States, where much of Western spending is concentrated, inflation has risen 25% since 2020: $1 today buys what $0.79 bought in 2020. Every game has been running a virtual discount if they haven't increased price!

There's an interesting side effect: 4X and games like Monopoly Go are somewhat inflation-protected, since their monetization systems operate like auctions focused on leaderboards. The real price for a top spot is more resilient to inflation than in PvE-dominant games like Candy Crush.

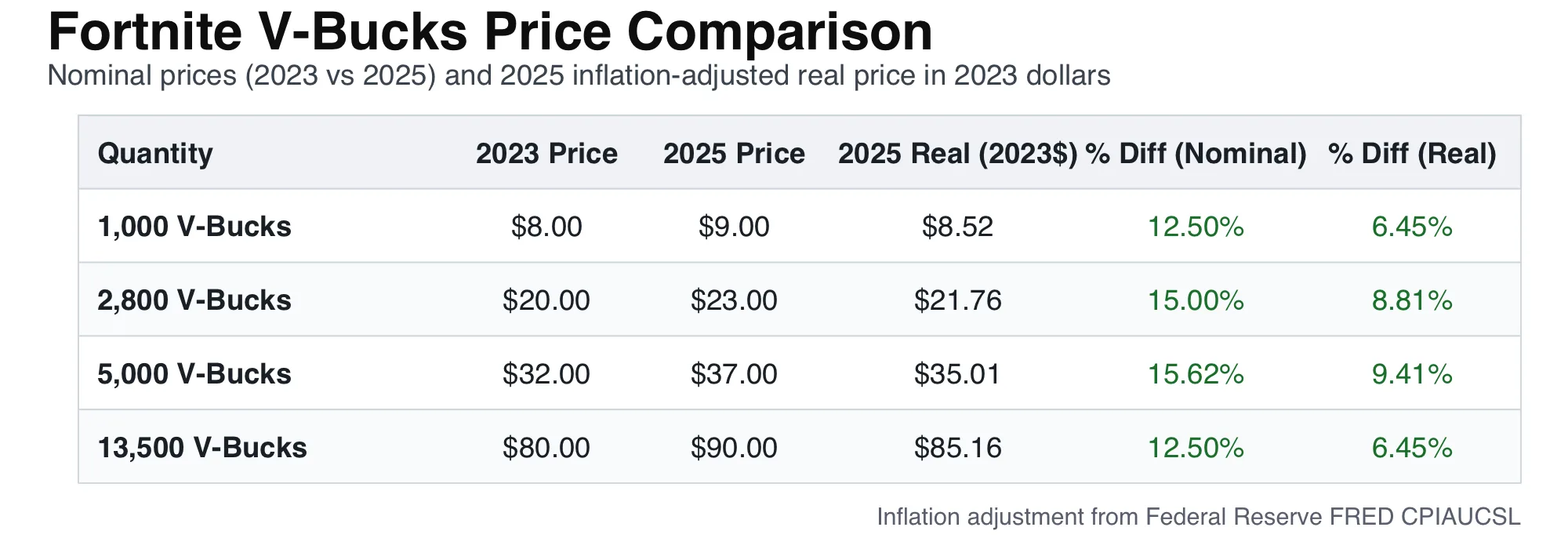

However, the inflation adjustment to currency prices is also far more modest. Epic is one of the few players to raise prices, but in real terms, the increases are nearly half as large as in nominal terms.